Delinquent Frederick County Va Personal Property Tax . Frederick county property records (virginia) find complete property records in frederick county, va. Access resources for transaction records,. Frederick county is allowed by the virginia dmv to stop renewals of vehicle registrations of any taxpayer that owes frederick county delinquent. The general assembly passed legislation regarding the initial vehicle registration of vehicles by those with delinquent taxes or fees,. Delinquent accounts are subject to collection action, which may include bank liens, employer liens, dmv renewal stops, distress warrants,. Adeshinaabayomi $473.17 adimmohammednasreddine $432.29 adkinscodyray $248.79 adkinsgene $27.02. Personal property taxes in frederick county are assessed by the commissioner of the revenue and collected by the treasurer. Use the map below to find your city or county's. If you have questions about personal property tax or real estate tax, contact your local tax office.

from www.signnow.com

The general assembly passed legislation regarding the initial vehicle registration of vehicles by those with delinquent taxes or fees,. Adeshinaabayomi $473.17 adimmohammednasreddine $432.29 adkinscodyray $248.79 adkinsgene $27.02. Frederick county property records (virginia) find complete property records in frederick county, va. Access resources for transaction records,. Delinquent accounts are subject to collection action, which may include bank liens, employer liens, dmv renewal stops, distress warrants,. Frederick county is allowed by the virginia dmv to stop renewals of vehicle registrations of any taxpayer that owes frederick county delinquent. If you have questions about personal property tax or real estate tax, contact your local tax office. Personal property taxes in frederick county are assessed by the commissioner of the revenue and collected by the treasurer. Use the map below to find your city or county's.

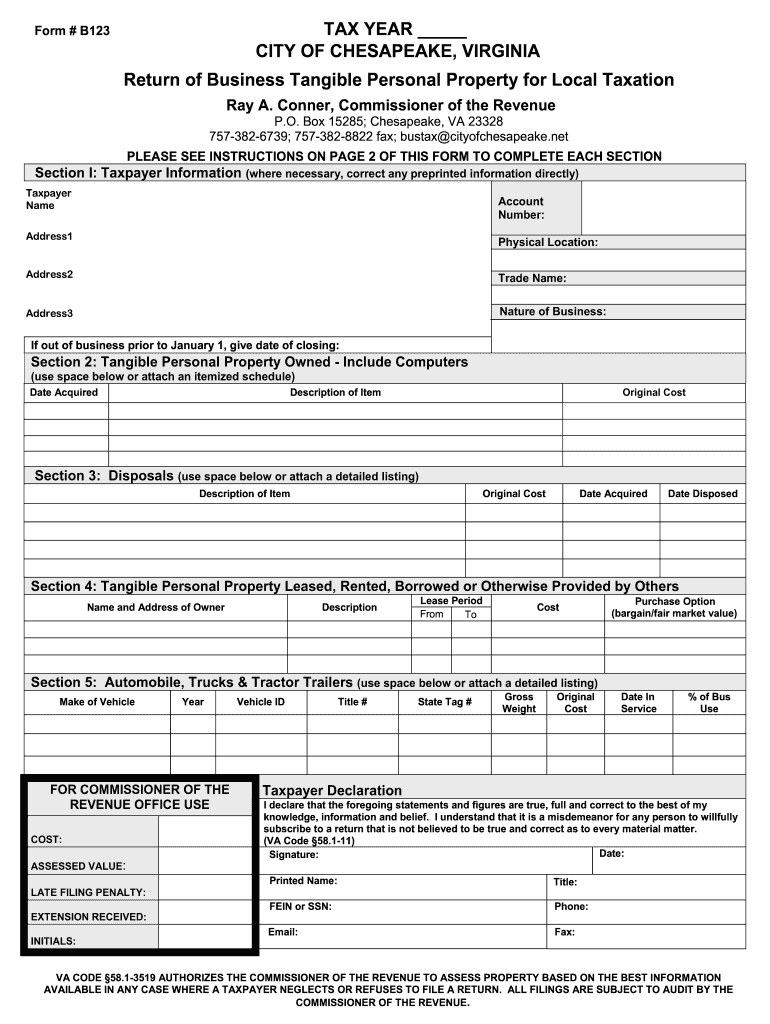

Personal Property Tax Chesapeake Va Complete with ease airSlate SignNow

Delinquent Frederick County Va Personal Property Tax Frederick county property records (virginia) find complete property records in frederick county, va. Adeshinaabayomi $473.17 adimmohammednasreddine $432.29 adkinscodyray $248.79 adkinsgene $27.02. Access resources for transaction records,. Personal property taxes in frederick county are assessed by the commissioner of the revenue and collected by the treasurer. Delinquent accounts are subject to collection action, which may include bank liens, employer liens, dmv renewal stops, distress warrants,. The general assembly passed legislation regarding the initial vehicle registration of vehicles by those with delinquent taxes or fees,. Use the map below to find your city or county's. Frederick county property records (virginia) find complete property records in frederick county, va. If you have questions about personal property tax or real estate tax, contact your local tax office. Frederick county is allowed by the virginia dmv to stop renewals of vehicle registrations of any taxpayer that owes frederick county delinquent.

From www.dochub.com

Delinquent property tax letter samples Fill out & sign online DocHub Delinquent Frederick County Va Personal Property Tax Delinquent accounts are subject to collection action, which may include bank liens, employer liens, dmv renewal stops, distress warrants,. If you have questions about personal property tax or real estate tax, contact your local tax office. Frederick county property records (virginia) find complete property records in frederick county, va. Access resources for transaction records,. Use the map below to find. Delinquent Frederick County Va Personal Property Tax.

From www.aladin.co.kr

알라딘 Northampton County, Virginia Personal Property Tax Lists 18211850 Delinquent Frederick County Va Personal Property Tax If you have questions about personal property tax or real estate tax, contact your local tax office. Access resources for transaction records,. The general assembly passed legislation regarding the initial vehicle registration of vehicles by those with delinquent taxes or fees,. Adeshinaabayomi $473.17 adimmohammednasreddine $432.29 adkinscodyray $248.79 adkinsgene $27.02. Use the map below to find your city or county's. Frederick. Delinquent Frederick County Va Personal Property Tax.

From www.13newsnow.com

Virginia's personal property taxes on the rise Delinquent Frederick County Va Personal Property Tax Delinquent accounts are subject to collection action, which may include bank liens, employer liens, dmv renewal stops, distress warrants,. Use the map below to find your city or county's. Personal property taxes in frederick county are assessed by the commissioner of the revenue and collected by the treasurer. Adeshinaabayomi $473.17 adimmohammednasreddine $432.29 adkinscodyray $248.79 adkinsgene $27.02. The general assembly passed. Delinquent Frederick County Va Personal Property Tax.

From www.cityofchesapeake.net

Personal Property Delinquent Tax Bill Chesapeake, VA Delinquent Frederick County Va Personal Property Tax Personal property taxes in frederick county are assessed by the commissioner of the revenue and collected by the treasurer. Use the map below to find your city or county's. Adeshinaabayomi $473.17 adimmohammednasreddine $432.29 adkinscodyray $248.79 adkinsgene $27.02. The general assembly passed legislation regarding the initial vehicle registration of vehicles by those with delinquent taxes or fees,. Access resources for transaction. Delinquent Frederick County Va Personal Property Tax.

From www.formsbank.com

Fillable Form Av9 Application For Property Tax Relief 2018 Delinquent Frederick County Va Personal Property Tax Access resources for transaction records,. The general assembly passed legislation regarding the initial vehicle registration of vehicles by those with delinquent taxes or fees,. Frederick county is allowed by the virginia dmv to stop renewals of vehicle registrations of any taxpayer that owes frederick county delinquent. Use the map below to find your city or county's. Frederick county property records. Delinquent Frederick County Va Personal Property Tax.

From prorfety.blogspot.com

Personal Property Tax Halifax Virginia PRORFETY Delinquent Frederick County Va Personal Property Tax The general assembly passed legislation regarding the initial vehicle registration of vehicles by those with delinquent taxes or fees,. Delinquent accounts are subject to collection action, which may include bank liens, employer liens, dmv renewal stops, distress warrants,. Personal property taxes in frederick county are assessed by the commissioner of the revenue and collected by the treasurer. Frederick county property. Delinquent Frederick County Va Personal Property Tax.

From www.scribd.com

VA Tax Exemption Form Use Tax Packaging And Labeling Delinquent Frederick County Va Personal Property Tax Adeshinaabayomi $473.17 adimmohammednasreddine $432.29 adkinscodyray $248.79 adkinsgene $27.02. Access resources for transaction records,. Frederick county property records (virginia) find complete property records in frederick county, va. Personal property taxes in frederick county are assessed by the commissioner of the revenue and collected by the treasurer. If you have questions about personal property tax or real estate tax, contact your local. Delinquent Frederick County Va Personal Property Tax.

From www.formsbank.com

Form Est80 Virginia Estate Tax Return printable pdf download Delinquent Frederick County Va Personal Property Tax Access resources for transaction records,. The general assembly passed legislation regarding the initial vehicle registration of vehicles by those with delinquent taxes or fees,. Personal property taxes in frederick county are assessed by the commissioner of the revenue and collected by the treasurer. Use the map below to find your city or county's. Delinquent accounts are subject to collection action,. Delinquent Frederick County Va Personal Property Tax.

From retipster.com

Everything You Need To Know About Getting Your County's "Delinquent Tax Delinquent Frederick County Va Personal Property Tax Access resources for transaction records,. Frederick county property records (virginia) find complete property records in frederick county, va. Frederick county is allowed by the virginia dmv to stop renewals of vehicle registrations of any taxpayer that owes frederick county delinquent. If you have questions about personal property tax or real estate tax, contact your local tax office. Use the map. Delinquent Frederick County Va Personal Property Tax.

From www.formsbank.com

Form Ri1040h Property Tax Relief Claim 1999 printable pdf download Delinquent Frederick County Va Personal Property Tax Access resources for transaction records,. Frederick county is allowed by the virginia dmv to stop renewals of vehicle registrations of any taxpayer that owes frederick county delinquent. Delinquent accounts are subject to collection action, which may include bank liens, employer liens, dmv renewal stops, distress warrants,. Personal property taxes in frederick county are assessed by the commissioner of the revenue. Delinquent Frederick County Va Personal Property Tax.

From www.formsbank.com

Fillable Form Otc 901 Business Personal Property Rendition printable Delinquent Frederick County Va Personal Property Tax Delinquent accounts are subject to collection action, which may include bank liens, employer liens, dmv renewal stops, distress warrants,. The general assembly passed legislation regarding the initial vehicle registration of vehicles by those with delinquent taxes or fees,. Frederick county is allowed by the virginia dmv to stop renewals of vehicle registrations of any taxpayer that owes frederick county delinquent.. Delinquent Frederick County Va Personal Property Tax.

From www.signnow.com

Personal Property Tax Chesapeake Va Complete with ease airSlate SignNow Delinquent Frederick County Va Personal Property Tax Adeshinaabayomi $473.17 adimmohammednasreddine $432.29 adkinscodyray $248.79 adkinsgene $27.02. Frederick county property records (virginia) find complete property records in frederick county, va. Frederick county is allowed by the virginia dmv to stop renewals of vehicle registrations of any taxpayer that owes frederick county delinquent. Access resources for transaction records,. Use the map below to find your city or county's. Personal property. Delinquent Frederick County Va Personal Property Tax.

From prorfety.blogspot.com

How To Pay Va Personal Property Tax Online PRORFETY Delinquent Frederick County Va Personal Property Tax Frederick county is allowed by the virginia dmv to stop renewals of vehicle registrations of any taxpayer that owes frederick county delinquent. Access resources for transaction records,. The general assembly passed legislation regarding the initial vehicle registration of vehicles by those with delinquent taxes or fees,. Delinquent accounts are subject to collection action, which may include bank liens, employer liens,. Delinquent Frederick County Va Personal Property Tax.

From www.casadellibro.com

CLARKE COUNTY VIRGINIA PERSONAL PROPERTY TAX LISTS de MARTY HIATT Delinquent Frederick County Va Personal Property Tax Use the map below to find your city or county's. Personal property taxes in frederick county are assessed by the commissioner of the revenue and collected by the treasurer. Delinquent accounts are subject to collection action, which may include bank liens, employer liens, dmv renewal stops, distress warrants,. Access resources for transaction records,. Adeshinaabayomi $473.17 adimmohammednasreddine $432.29 adkinscodyray $248.79 adkinsgene. Delinquent Frederick County Va Personal Property Tax.

From www.templateroller.com

Lee County, Florida Delinquent Tangible Personal Property Tax Payment Delinquent Frederick County Va Personal Property Tax Frederick county is allowed by the virginia dmv to stop renewals of vehicle registrations of any taxpayer that owes frederick county delinquent. Adeshinaabayomi $473.17 adimmohammednasreddine $432.29 adkinscodyray $248.79 adkinsgene $27.02. The general assembly passed legislation regarding the initial vehicle registration of vehicles by those with delinquent taxes or fees,. Use the map below to find your city or county's. Frederick. Delinquent Frederick County Va Personal Property Tax.

From fity.club

Sample Property Tax Bills Delinquent Frederick County Va Personal Property Tax The general assembly passed legislation regarding the initial vehicle registration of vehicles by those with delinquent taxes or fees,. Adeshinaabayomi $473.17 adimmohammednasreddine $432.29 adkinscodyray $248.79 adkinsgene $27.02. Personal property taxes in frederick county are assessed by the commissioner of the revenue and collected by the treasurer. Delinquent accounts are subject to collection action, which may include bank liens, employer liens,. Delinquent Frederick County Va Personal Property Tax.

From www.forsaleatauction.biz

Cumberland County, VA Tax Delinquent Real Estate Delinquent Frederick County Va Personal Property Tax Personal property taxes in frederick county are assessed by the commissioner of the revenue and collected by the treasurer. Delinquent accounts are subject to collection action, which may include bank liens, employer liens, dmv renewal stops, distress warrants,. Adeshinaabayomi $473.17 adimmohammednasreddine $432.29 adkinscodyray $248.79 adkinsgene $27.02. The general assembly passed legislation regarding the initial vehicle registration of vehicles by those. Delinquent Frederick County Va Personal Property Tax.

From www.dochub.com

Spotsylvania personal property tax lookup Fill out & sign online DocHub Delinquent Frederick County Va Personal Property Tax If you have questions about personal property tax or real estate tax, contact your local tax office. The general assembly passed legislation regarding the initial vehicle registration of vehicles by those with delinquent taxes or fees,. Access resources for transaction records,. Delinquent accounts are subject to collection action, which may include bank liens, employer liens, dmv renewal stops, distress warrants,.. Delinquent Frederick County Va Personal Property Tax.